In the United States, it is essential for individuals to establish their financial reputation from scratch, which is achieved through the Credit Score system. This indicator assesses a person’s financial responsibility by considering transactions such as buying cars and renting houses in the US.

Thus, it is noted that the perspective on credit is fundamentally different in the United States compared to Brazil. Throughout this text, the concept of Credit Score and the reason for its importance in the United States will be elucidated.

Additionally, guidance will be provided for building this credit score, including tips to avoid mistakes and maintain a good credit history. Get ready to acquire more knowledge about this crucial subject for your life in the US by continuing to read.

Understanding credit score

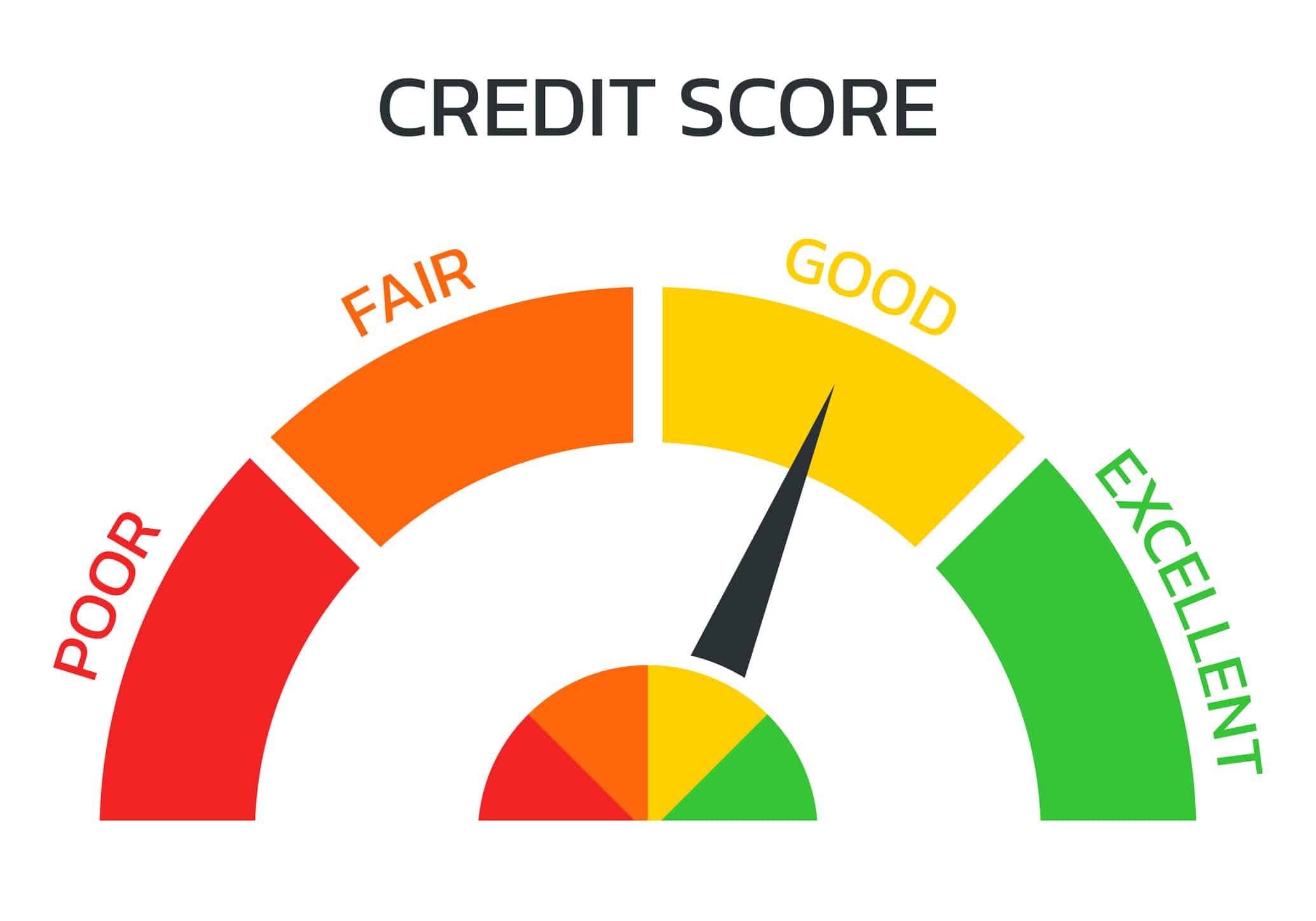

The Credit Score is an evaluation system that informs lenders how reliable a person is in terms of meeting their financial obligations. The higher this score is, the lower the interest rates applied, in case there is a need for financing, for example, for the acquisition of real estate or vehicles.

It is through this system that financial achievements, such as realizing the dream of owning a house in the United States, become possible. Additionally, the Credit Score is considered by companies in the process of hiring employees.

As individuals establish their lives in the United States, they take on more substantial financial commitments, which directly influence the perception of their financial reputation.

Unlike Brazil, where an individual’s credit history is associated with the CPF, in the US, it is linked to the SSN (Social Security Number). This number guarantees various rights to residents and citizens of the country.

However, if an immigrant does not possess this document, it is possible to start accumulating a score associated with the ITIN Number (Individual Taxpayer Identification Number).

Importance of credit score in the US

A low Credit Score in the US results in limited options for loans and financing, with higher interest rates, especially if the score is below 700. This reflects the American culture, which values hard work and people’s efforts to achieve their goals, whether personal or professional.

This aspect is evident from the individuals’ arrival in the country. Therefore, when people are financially educated and maintain a good credit history, there is a tendency not only to multiply wealth but also to enjoy the American comfort, where their reputation is respected, and their credibility is reinforced.

Strategies for obtaining credit in the US

It is essential to understand the three essential stages of the Credit Score:

- Credit maintenance: involves the timely payment of all basic bills, such as water, electricity, and phone.

- Credit building: after regularizing basic expenses, it is important to apply for a credit card at a bank. This allows for the recording of your purchase and payment history, initiating the accumulation of points in the Credit Score.

- Credit protection: refers to the risk of credit-related fraud, which becomes even more important considering the significant volume of online purchases.

Strategies for maintaining a good credit score

To maintain a high Credit Score, it is important to consider the following aspects:

- The amount of revolving credit used.

- The length of time accounts have been open.

- The types of accounts you maintain.

- The history of loan payments and credit cards.

- The frequency with which you apply for new credit.

Guidelines for using credit score correctly

Do you want to maintain a consistently high Credit Score? Pay attention to the following fundamental tips:

- Avoid payment delays: Delays in bill payments, such as for electricity, can result in a reduction of the Credit Score. This also applies to delays in paying other basic bills, such as rent and credit card bills. If you always pay these expenses on time, it is advisable to approach a bank to initiate the point accumulation process. In case of any delays, it is possible to overcome the situation provided that the outstanding debts are settled and there is an interval before approaching a bank to start the second stage mentioned earlier (applying for a credit card).

- Keep credit card balances below the limit: Even if you have a credit limit of $10,000 on an American credit card, maintaining a balance close to the limit every month can negatively affect the Credit Score. To maintain a high score, it is advisable to use less than 30% of the limit. Lenders and financial institutions will recognize that you are a prudent manager of your finances, which will facilitate obtaining credit at favorable rates.

- Keep credit cards active: Even if you have five credit cards and consider getting rid of one of them, know that this is not a recommended practice to maintain a good Credit Score. It is crucial to use all cards regularly, even if sporadically. Additionally, it is essential to pay the bill as soon as it is issued.

The Credit Score is a fundamental indicator that demonstrates the discrepancy between American and Brazilian understandings of credit. When establishing oneself in the United States, it is necessary to start from scratch, even if you have a solid payment history in Brazil. However, this transition is seen as a crucial step in building a successful life in the United States and reaping future benefits.