By: Alicia

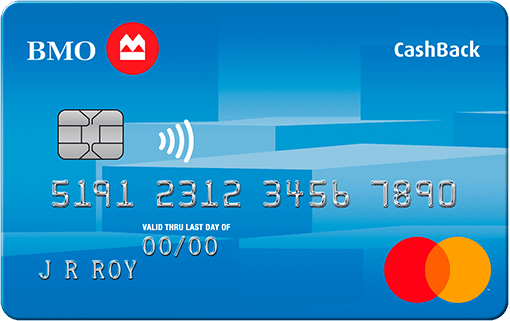

Holders of the BMO CashBack® Mastercard® for Students have the opportunity to earn cash back on their purchases, providing a financial incentive for regular use. By using the card for everyday expenses, students can accumulate a percentage of their spending as cash rewards, which can be redeemed later. This feature not only aids in managing finances but also encourages budgeting and smart spending habits among students. Additionally, the card may come with other benefits such as no annual fees, enhancing its appeal to students who are often mindful of their budget constraints.

This card does not charge an annual fee, which makes it an especially affordable and attractive option for students who are seeking to obtain a credit card without the burden of additional costs. By eliminating this common expense, students can manage their finances more effectively as they navigate their academic and personal demands. Additionally, without the worry of an annual fee, students are able to focus on using their credit card responsibly to build a healthy credit history from the start, laying a solid foundation for their financial future.

Often, the card offers a low introductory interest rate for initial purchases, which can be particularly beneficial for students who find themselves in need of financing significant expenses associated with their educational journey. These expenses can include textbooks, research materials, and school supplies that are essential for their studies. Additionally, this kind of financial flexibility can be helpful in managing other costs associated with college life, such as buying laptops or other technology tools necessary for assignments and projects. Through this approach, students are provided with an opportunity to manage their budgets more effectively during the critical early stages of their academic careers.

The BMO CashBack® Mastercard® for Students typically offers some noteworthy benefits that are designed to add an extra layer of financial security to your purchases. One of the primary advantages is purchase protection, which means that if any items you buy with the card are accidentally damaged or stolen within a specified period, you may be eligible for reimbursement or replacement. This feature can provide peace of mind, especially for students balancing the purchase of necessary items for school and personal use. Additionally, the card features extended warranty insurance, which helps extend the manufacturer’s warranty on eligible items. This means that if a product malfunctions or requires repairs after the original warranty period has expired, you might still have coverage, potentially saving money on repair costs or the need to purchase new replacements. This combination of protections can be particularly valuable for students who need to ensure that their electronics, study materials, and other purchases remain in good condition throughout their studies.

This card typically offers the convenience of contactless payment, enabling cardholders to perform transactions with just a simple tap, swiftly and efficiently. This feature ensures that payments are made without the need for physical contact, reducing the wear and tear on both the card and the payment terminal. It enhances the security of transactions by using dynamic encryption, which is especially useful in fast-paced shopping situations like grocery stores, coffee shops, or public transportation, where every second counts and queues can grow quickly. By eliminating the need to enter a PIN or hand over cash, contactless payments also minimize the exchange of germs, adding an extra layer of safety and hygiene.

The BMO CashBack® Mastercard® for Students is a thoughtfully structured credit card tailored to meet the financial needs of university and college-aged individuals who are seeking both convenience and rewards without the burden of high fees.

Rewards and Incentives

Cardholders receive a straightforward 3% cash back on eligible grocery purchases and 1% cash back on recurring bill payments, such as utilities or subscriptions. All other purchases earn 0.5% cash back. This streamlined rewards system aligns well with typical spending habits of students, delivering tangible value without unnecessary complexity.

Accessibility and Fees

The card maintains a $0 annual fee, making it highly accessible for students who are budget-conscious or just beginning to build their credit history. It also features no introductory interest charges for balance transfers made within the first three months, enhancing its utility as a low-cost financial tool during transition periods.

Student-Friendly Features

Designed with student life in mind, the card includes digital banking tools that simplify tracking expenses and planning budgets. With mobile wallet compatibility (like Apple Pay and Google Pay), contactless payments are seamless, and expense notifications help reinforce financial awareness. Additionally, most BMO branches on or near campuses provide convenient in-person support if needed.

Security and Protections

Comprehensive security measures are in place, including zero-liability protection for unauthorized transactions and real-time alert notifications. The card also offers fraud monitoring and emergency card replacement services—important safeguards for young adults who may frequently shop online or rely on digital payments.

Why It Stands Out

This card balances everyday rewards with simplicity and security, positioning it as a smart introductory credit card. The focus on groceries and recurring payments reflects typical student spending patterns, and the absence of fees eliminates unnecessary financial burdens. Combined with digital tools and security protections, it provides a well-rounded financial tool for students who seek responsible credit use with practical benefits.

Ideal Candidate

Best suited for students earning their own income and wanting to establish credit, this card provides initial financial education in a supportive framework. It’s designed to drive positive spending habits, build credit responsibly, and offer real value where it matters most—making it an excellent companion for college or early career life.