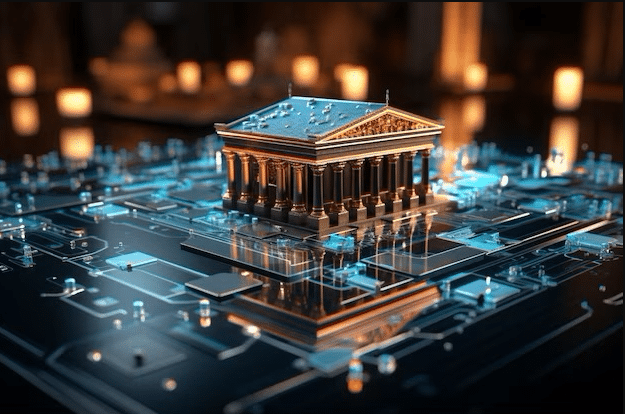

In recent years, the fintech revolution has significantly transformed the way Americans handle their finances, making financial management more accessible and personalized. The growing popularity of fintech, a term coined from “financial technology,” has introduced innovative solutions that are challenging traditional banking systems.

This digital transformation is driven by advancements that have made transaction processing more seamless, offering everything from budgeting tools to investment platforms. Americans are adopting these technologies to gain better control over their financial well-being. In this post, we explore the impact of these innovations, the challenges faced, and the opportunities they present.

Innovative solutions reshaping financial management

The emergence of fintech has paved the way for countless innovative tools that fundamentally alter how individuals manage their finances. Among these, mobile banking apps have gained immense popularity, enabling users to handle their financial activities from the palm of their hands anytime, anywhere. These apps offer instant access to account balances, transaction histories, and allow users to effortlessly pay bills and transfer funds.

Moreover, digital wallets are another revolutionary development, simplifying the process of making payments both in-person and online. These wallets not only enhance convenience but also provide robust security through biometric authentication and encryption technologies. Additionally, budgeting apps are empowering users to set and track financial goals, offering insights into spending habits and encouraging smarter financial decisions.

The proliferation of automated financial advisors, or robo-advisors, has democratized investment opportunities. These digital platforms offer tailored investment advice based on algorithms, providing a cost-effective alternative to traditional financial advisors. Such innovations are putting sophisticated financial tools within reach of the average consumer.

Budgeting and saving made easy

One significant advantage of fintech solutions is their ability to simplify budgeting and saving. Traditional methods involving spreadsheets and manual tracking are becoming obsolete, thanks to apps that seamlessly integrate with users’ bank accounts. These platforms categorize spending, offer personalized insights, and assist in setting realistic financial goals.

Furthermore, automatic saving features are becoming more prevalent, rounding up purchases and funneling the extra change into savings accounts. This painless way of saving helps consumers accumulate wealth gradually without feeling the pinch in their daily spending. Additionally, many fintech solutions offer tailored advice, helping users optimize their saving strategies based on their unique financial situation.

Investment opportunities for all

Fintech platforms have made investing more accessible than ever before. In the past, investing was often seen as an exclusive domain for the wealthy, but digital tools have broken down these barriers. Robo-advisors provide affordable asset management services, allowing individuals to invest in diversified portfolios with minimal initial capital.

Additionally, micro-investing apps have opened up the world of trading to those with limited funds. By allowing users to invest small amounts of money, these platforms democratize the investment process, enabling anyone to participate in the stock market and other investment avenues.

Overcoming challenges in the fintech space

While the fintech revolution has introduced numerous benefits, it is not without its challenges. The rapid pace of innovation has outpaced regulatory frameworks, necessitating the establishment of guidelines to protect consumers’ interests. Ensuring data security and privacy remains a paramount concern, prompting ongoing efforts to bolster cybersecurity measures.

Additionally, technological accessibility poses a hurdle for some demographics, particularly older generations who may be less comfortable adapting to digital platforms. Bridging this gap requires targeted education and support to help all individuals leverage the advantages fintech offers.

Data security and privacy concerns

Data security is a top priority as more consumers share personal information with fintech platforms. The threat of data breaches and cyberattacks is ever-present, placing pressure on companies to employ robust security protocols. Encryption, multifactor authentication, and regular security audits are crucial in safeguarding user data.

Consumers must also be vigilant, opting only for platforms with a proven track record of security and a commitment to protecting user information. Regulatory bodies are increasingly mandating compliance with data protection standards, providing an additional layer of security.

Bridging the digital divide

Promoting digital inclusivity is essential for the widespread adoption of fintech solutions. Efforts are being made to educate various demographics about the benefits and functionalities of these tools. Financial literacy programs are crucial in helping individuals understand and confidently use digital finance platforms. Initiatives aimed at simplifying user interfaces and providing assistance for first-time users can ease the transition for those less familiar with technology.